Central Bank of India Recruitment happens every year for various posts. Candidates who are interested in working at the Bank Sector with good income and job stability can check the eligibility criteria, exam syllabus and exam pattern in this article. The idea of an exam structure can help candidates beat the competition for apprentice and credit officer posts. The main four sections are important to prepare first and other skill tests or sections are included according to the post.

The apprentice post is a one year training program for candidates who want to step into the world of banking in the government sector. It offers a monthly stipend but is valuable for the candidates to assess exposure to banking & finance.

The credit officer is a permanent post which offers high salary and allowance with increment for each year. So, this post has a lot of perks and responsibility which is attractive to the candidates.

Central Bank of India Recruitment 2025 Eligibility

Candidates can check eligibility before applying to the central bank of India recruitment application. The online form 2025 will soon be released on the official website.

Educational Qualification: Candidates who have completed their graduation in specific disciplines for particular positions. The minimum score must be 50% but some positions may require additional skills and experience.

Computer Skills: Basic computer skills like fundamentals, MS Office, Powerpoint, Excel, and operating system.

Language Proficiency: Proficiency in local language is mandatory for the candidate to work in railways.

Age limit: Caste category also matters in the age limit – the age range is between 20 to 28 years. Age relaxation is provided to the reserved category.

Syllabus for Central Bank of India Recruitment 2025

There are four sections of the paper for Central Bank of India Recruitment. Each section carries out different types of topics such as Quantitative Aptitude, Logical Reasoning, English, and General Awareness. These four are core sections for the exam, some positions require a descriptive paper based on their skills.

The Central Bank Of India Apprentice post required computer knowledge with local language tests for candidates to prove their skills.

The Central Bank of India Credit officer post required writing skills for descriptive paper. So, both the posts require some basic knowledge on specific skills. You must understand the exam pattern and syllabus to clear this exam.

| Quantitative Aptitude | Basic Mathematics – Number Series, LCM & HCF, Ratio & Proportion, SI & CI, Percentage, Data Interpretation, Geometry, and Algebra |

| Reasoning | Logic Building – Sequences, Coding-Decoding, Blood Relations, Verbal Reasoning, Odd one Out, Syllogism, Puzzle |

| English | Basic Grammar – Error Spotting, Indirect/Direct, Active/Passive, One Word, Synonyms/Antonyms, Sentences making |

| General Awareness | Banking Related Knowledge – RBI regulations, Current Affairs, Banking Knowledge, Static GK, Economic policies and Development |

| Computer Knowledge | Basic Fundamentals – Networking, MS office, Excel, Internet Knowledge, Devices and Tools knowledge |

| Descriptive | Letter & Essay Writing |

Central Bank of India Exam Pattern for Apprentice Post

The total of 100 questions paper and each question carries one mark. It’s a good thing that there is no negative marking in this paper but the duration is only 60 minutes. The exam is conducted online and the question paper contains objective type questions.

| Section | Questions | Marks |

| Quantitative Aptitude | 15 | 15 |

| Logical Reasoning | 15 | 15 |

| English Language | 15 | 15 |

| Computer Knowledge | 15 | 15 |

| Basic Insurance Products | 10 | 10 |

| Basic Investment Products | 10 | 10 |

| Basic Retail Asset Products | 10 | 10 |

| Basic Retail Products | 10 | 10 |

Central Bank of India Exam Pattern for Credit Officer Post

There are a total of 120 questions and each carries one mark. The four main sections have 30 questions and 2 from descriptive – letter writing and essay. The duration is 120 minutes for this paper and there is no negative marking.

| Section | Question | Marks |

| English | 30 | 30 |

| Quantitative Aptitude | 30 | 30 |

| Reasoning | 30 | 30 |

| General Awareness | 30 | 30 |

| Descriptive Test | 2 | 30 |

Preparation Tips For Central Bank of India Recruitment

You can start preparing for these basics from any 10th class books or online resources. There are plenty of videos on youtube which can help you understand basic knowledge in each subject. Online tutorials are better than offline coachings as students can learn from anywhere and anytime without struggling to go to coaching centres regularly. Any professional can also start preparations today with the help of online material.

For Quantitative and Logical reasoning, you must regularly practice mock test series and previous years papers. Keep updates with current affairs and recent policies for General Awareness. Try out English Grammar test questions for practice.

Central Bank of India Apprentice Jobs Salary

This is apprenticeship so the stipend is fixed around Rs. 15000 per month with no other additional benefits. This will continue for one year and sometimes the bank may relocate you for this post.

This is best for students who want to start their career in Central Bank Jobs. This post focuses on training but there is no security like a permanent job.

The responsibilities included assisting in daily operations such as customer service, handling account and product queries, helping opening and closing accounts, making reports, documents and bank office operations.

Career Growth is depends on your performance because there is not direct

Read More 👉 Reserve Bank RBI Officers Grade B Online Form 2025 Released – Apply Now with Full Details by Gov Update Wala

Central Bank of India Credit Officer Jobs Salary

Starting salary for Credit Officer is around Rs. 48,480 and total In-hand approximately Rs. 50,000 to Rs. 90,000 including allowances. There is an increment in every year for credit officer salary.

This is a permanent job but candidates have to complete one year post graduate diploma in finance and banking. The credit officer is responsible for appraising loans, analyzing financial statements, monitoring people accounts, managing NPAs and developing strategies for maintaining operations.

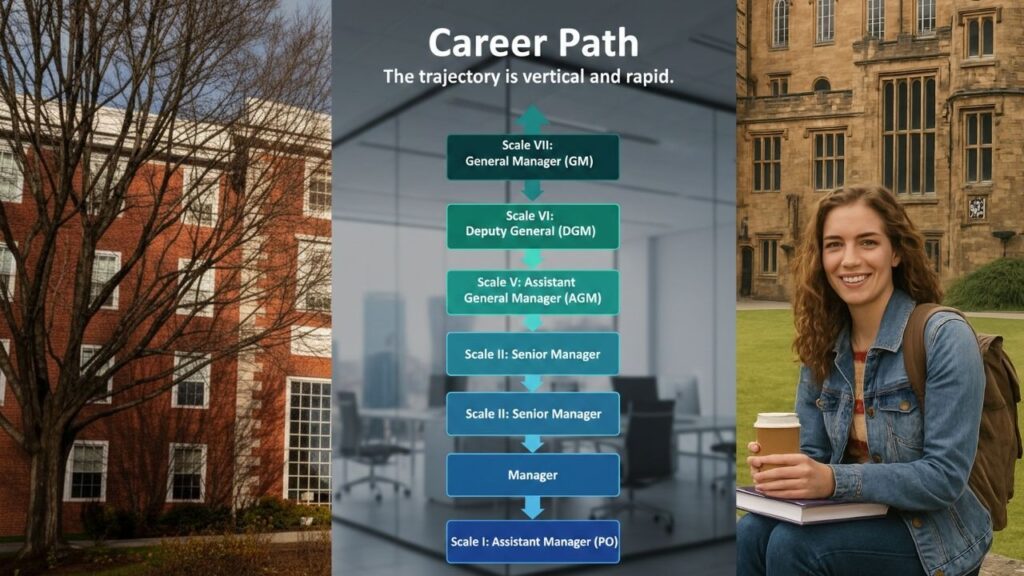

The career growth is good because after experience as a credit officer, candidates are eligible to apply for senior positions, chief manager, assistant general manager, and more. But the promotion depends on the candidate’s performance and qualifications.

Eligibility criteria for Central Bank of India Recruitment

Eligibility depends on the posts in CBI, some posts require specific certifications and experience but some posts can give you a chance to work at CBI. Let’s dive deeper into the eligibility for both apprentice and credit officer posts.

Central Bank of India Apprentice Educational Qualification

Graduation degree with minimum 50% score in any discipline. Candidates must have proof of the degree they claimed.

Age Limit

| Minimum | 20 years |

| Maximum | 28 years |

| Age Relaxation | |

| OBC (NCL) | 3 years |

| SC/ST | 5 years |

| PWD (Gen/EWS) | 10 years |

| PwBD (OBC): | 13 years |

| PwBD (SC/ST) | 15 years |

Central Bank of India Credit Officer Educational Qualification

Graduation with at least 60% score for general and 55% for reserved categories. Candidates must have a proof marksheet of the education from a recognized university in any discipline. Candidates have to pursue post graduate diploma after the selection in finance & banking.

Age Limit

| Minimum | 20 years |

| Maximum | 30 years |

| Age Relaxation | |

| SC/ST | 5 years |

| OBC | 3 years |

| PwBD | 10 years |

Conclusion

The Central Bank of India offers various posts through their recruitment process which happens each year. Interested candidates can start their preparation in core sections of the paper such as English, Mathematics, General Awareness, and Logical & Reasoning. These four sections are mandatory follows up with the descriptive test & computer knowledge. Candidates can check recruitment dates on the official website of the CBI. Practice everyday for each section to prepare yourself before the exam.